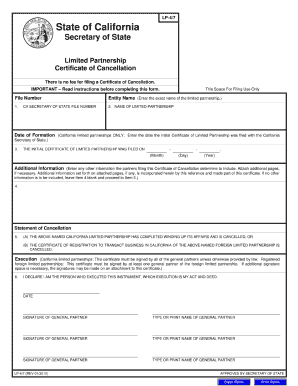

CA LP-4/7 2013-2024 free printable template

Get, Create, Make and Sign

How to edit california partnership certificate online

CA LP-4/7 Form Versions

How to fill out california partnership certificate 2013-2024

How to fill out lp 4 7:

Who needs lp 4 7:

Video instructions and help with filling out and completing california partnership certificate

Instructions and Help about california 4 7 form

Hey there today I'm going to be showing you how to start a corporation in the state of sunny California so incorporating in California generally requires the incorporated to fill out an article of corporation form now this isn't in its in and of itself like incredibly difficult, but California just happens to have a very nice variety of corporations to choose from when forming as you can see here, so you want to be sure when you are forming them that you're getting the formation, or you're choosing the type of corporation that fits the structure of your business most exactly so for instance domestic are businesses that are within California state borders and are going to be are it's a new business you're forming foreign if it's a foreign corporation what it is essentially is that you're taking a corporation that exists outside of California and opening up some sort of branch or leg of York operation into California so once you have your name set up as this can as a step one says what you can do through the California name reservation service and more information on that there you are going to select as I said these type of corporation now we have information on all of these so see you want to form a closed corporation with under 35 members you click there and then there's your phone and as we if you're is you want more information on then you can hit domestic where we have a page that shows you for you know you can see they're all over here it gives you just a brief thing a picture of the form and the information you're going to have on hand to complete a brief type of corporation, so we'll just scroll back through those this number to the right here is the filing fee so if it's a for-profit it'll be a hundred nonprofit 30 regardless of whether it's foreign or domestic, and you'll have to if you're a foreign corporation you must also include a certificate of Good Standing from the initial place of where you were incorporated now nonprofit corporations must have a certificate in good standing this is still performed which specifically mentions their nonprofit status, so that's important to remember now once you've gotten your form together you can either mail it or drop it off in person to the Secretary of State's office dependent in you know the addresses differ depending on your preferred delivery method articles dropped off in person will require an additional $15 check for a special handling and then finally within 90 days of incorporating you have to file statement of information it's very easy it's an honor it's the only form that I've seen as far as entity formation in California was that you can file online so, and you have to do it every year to keep your corporation current beyond that as I said with the statement of information for renewing your corporation that that's what you have to do there's more information on that here and all the links that you would expect to have your fingertips here with start a business org you have your...

Fill lp 4 secretary : Try Risk Free

People Also Ask about california partnership certificate

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your california partnership certificate 2013-2024 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.