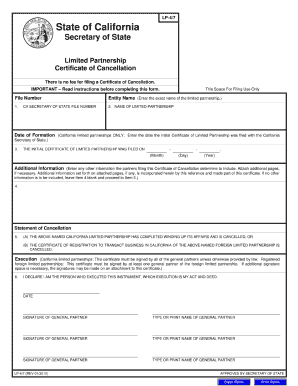

CA LP-4/7 2013-2026 free printable template

Show details

Changes to California Business Entity Filings (Updated May 15, 2013)

As of January 1, 2013, new legal requirements apply to business entity documents filed with the California Secretary of State's

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign california cancellation form

Edit your form lp 4 7 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your llc4 7 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit certificate of formation california online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit certificate of cancellation form llc 4 7. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CA LP-4/7 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out llc 4 7 form

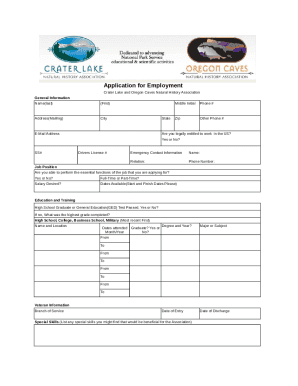

How to fill out CA LP-4/7

01

Obtain the CA LP-4/7 form from the appropriate state agency or website.

02

Fill in your personal information at the top of the form, including your name, address, and contact details.

03

Provide details regarding your employment or business activities as required.

04

Include any relevant identification numbers or license numbers as specified.

05

Complete sections related to your qualifications or history as needed.

06

Review the form for accuracy and completeness.

07

Sign and date the form in the designated area.

08

Submit the completed form to the appropriate agency, either online or via mail.

Who needs CA LP-4/7?

01

Individuals or businesses seeking to apply for or renew a California professional license.

02

Applicants needing to report certain information as part of their licensing process.

03

Those who are required to provide updates on qualifications or employment status.

Fill

form llc 4 7

: Try Risk Free

People Also Ask about form llc 4 7 certificate of cancellation

How do I dissolve an LP in California?

Domestic (California) limited partnerships: To cancel the Certificate of Limited Partnership of a California limited partnership (LP), the LP must file a Certificate of Dissolution (Form LP-3) and Certificate of Cancellation (Form LP-4/7).

Where do I mail my California dissolution certificate?

The completed form can be mailed to Secretary of State, Document Filing Support Unit, 1500 11th Street, 3rd Floor, Sacramento, CA 95814 or delivered in person to the Sacramento office. If you are not completing this form online, please type or legibly print in black or blue ink.

How do I file an LP in California?

Steps to Form a Limited Partnership in California Step 1: Register with the California Secretary of State. Step 2: Prepare a Partnership Agreement. Step 3: Get Local Business License and Comply With Local Laws. Step 4: Obtain an Employer Identification Number (EIN) Step 5: Pay California Limited Partnership Taxes/Fees.

Do California corporations have to pay the $800 first year?

California law generally imposes a minimum franchise tax of $800 on every corporation incorporated, qualified to transact business, or doing business in California. A corporation that incorporates or qualifies to do business in California is exempt from paying the minimum franchise tax in its first taxable year.

How do I dissolve a limited partnership in California?

Domestic (California) limited partnerships: To cancel the Certificate of Limited Partnership of a California limited partnership (LP), the LP must file a Certificate of Dissolution (Form LP-3) and Certificate of Cancellation (Form LP-4/7).

What is the annual LP fee in California?

The limited partnership annual tax is $800. To be subject to the tax, the limited partnership must for at least one day during the year be: Doing business in California, and/or.

What is the difference between LLC 3 and LLC 4 7?

Form LLC-3 is the Certificate of Dissolution that will need to be filed if you choose to dissolve your LLC in the State of California. Keep in mind that if all members vote to dissolve the LLC, then Form LLC-3 is not required, and the only document to be filed is Form LLC4/7, which is the Certificate of Cancellation.

What is form LLC 4 7 for?

In order to terminate the LLC, the LLC also must file a Certificate of Cancellation (Form LLC-4/7). 4. Read and Sign Below (Do not use a computer generated signature.) By signing, I affirm under penalty of perjury that the information herein is true and correct and that I am authorized by California law to sign.

Who signs LLC 4 7?

For California LLCs: This Form LLC- 4/7 must be signed by the managers, unless the LLC has had no members for 90 consecutive days, in which case the form must be signed by the person(s) authorized to pay liabilities, distribute assets and terminate the LLC.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete llc 4 7 pdf online?

pdfFiller has made it easy to fill out and sign llc 4 7 california. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

How do I edit llc 4 7 form in Chrome?

california form llc 4 7 can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

How do I fill out certificate of cancellation using my mobile device?

Use the pdfFiller mobile app to fill out and sign lp 47 on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

What is CA LP-4/7?

CA LP-4/7 is a specific form utilized by certain organizations in California to report payroll information for tax and regulatory compliance.

Who is required to file CA LP-4/7?

Employers in California that have employees and meet certain payroll requirements are typically required to file CA LP-4/7.

How to fill out CA LP-4/7?

To fill out CA LP-4/7, employers must provide accurate payroll data, including employee information, wages, taxes withheld, and other relevant financial information as outlined in the form's instructions.

What is the purpose of CA LP-4/7?

The purpose of CA LP-4/7 is to ensure that employers report accurate payroll data to comply with state tax laws and regulations.

What information must be reported on CA LP-4/7?

The information that must be reported on CA LP-4/7 includes employee names, Social Security numbers, total wages paid, taxes withheld, and any other necessary payroll details according to state guidelines.

Fill out your CA LP-47 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Filing Page California is not the form you're looking for?Search for another form here.

Keywords relevant to write 47 in expanded form

Related to llc 4 7 certificate of cancellation

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.